ADD TIME: 2021-06-16

CLICK COUNT: 579

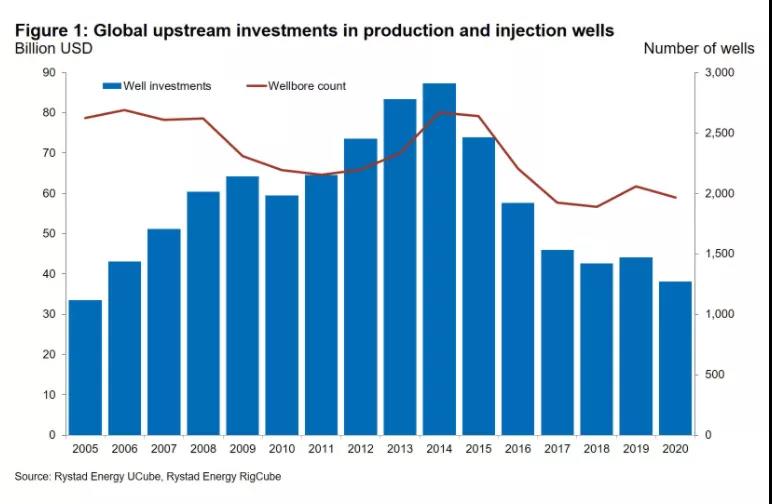

The offshore oil and gas industry has managed to significantly reduce costs and increase well productivity since the 2014 oil price crash, resulting in significantly lower break-even oil prices for offshore field development projects.Offshore production levels have remained stable despite a slowdown in offshore activity due to lower investment and fewer Wells being drilled.Rystad Energy estimates that global offshore liquids production in 2021 will be roughly the same as in 2014, at about 26.4 million b/d, meaning that the offshore oil and gas industry has become a very competitive source of supply.Investment in offshore drilling has fallen sharply since 2014, from nearly $90 billion spent on producing and injection Wells seven years ago to about $38 billion last year (see Figure 1). This represents a drop of more than 55 percent over a seven-year period.In terms of the number of offshore production and injection Wells completed, offshore oil and gas activity peaked in 2014, but the decline in the number of Wells drilled was significantly smaller.Between 2014 and 2020, the number of new offshore Wells fell by only 25% from about 2,700 to about 1,950.